Blogs

President McHenry, Ranks Associate Seas and People in the brand new Panel, thank you for the ability to appear before the Committee today to deal with the fresh federal authorities’ response to recent lender disappointments. As the talked about later on the declaration, SVBFG’s extra payment methods might have recommended a lot of chance-getting. The newest oversight out of SVBFG are difficult by change away from SVBFG, due to its quick development in assets, in the RBO collection to the LFBO profile within the Government Put aside supervisory structure inside the February 2021. Following its quick https://mrbetlogin.com/crazy-chameleons/ development, SVBFG managed to move on for the LFBO collection in the 2021 and is topic to another location set of supervisory and you may regulating criteria. FRBSF based a different team so you can monitor SVBFG since the an LFBO business inside March 2021, including an expansion to help you 20 someone, upwards from about 8 people if you are SVBFG was in the newest RBO collection. A glance at the newest supervisory checklist shows that supervisory judgments was not always compatible considering the seen defects from SVBFG (see the «Government Reserve Supervision» part plus the «Oversight away from SVBFG by Crucial Risk Components» section).

Rates record for Lie Bank’s Cd membership

ZURICH (Reuters) -An excellent Zurich court is found on Saturday reading an interest from the lenders found guilty a year ago out of failing continually to check around in the monetary deals just after helping an almost pal out of Vladimir Putin flow hundreds of thousands from francs because of Swiss bank account. Read the term deposit picture above for a failure out of the big costs around the for every name. Financial institutions have a tendency to greeting rates slices and you may status label put rates correctly, often lower than they’ve been in the relatively high interest rate environments. The new Ukrainian government’s said commitment to implement full economic change is actually a pleasant development in the newest sight of your You bodies, plus the United states is invested in support Ukraine inside the persisted to your it road. Two-sided relationships suffered a drawback inside September 2002 when the government government of your own Us established they had validated a recording away from President Leonid Kuchma’s July 2000 decision to import a Kolchuga very early alerting program in order to Iraq. Ukraine’s democratic Orange Revolution features led to nearer collaboration and a lot more open talk ranging from Ukraine and also the United states.

Furthermore, this type of financial institutions move from holding around eleven percent out of total reciprocal dumps to around 40 percent. Whenever mutual dumps were introduced in the 2003, these people were treated because the brokered dumps underneath the concept of a deposit broker the FDIC utilized at that time. The intention of it Monetary Comments would be to establish a brief history out of reciprocal places, as to the reasons they are mostly utilized by intermediate-size of banks, and you can just what limits the wider play with. We will in addition to determine expanded-identity manner inside put insurance coverage that have led to the increase regarding the entry to mutual deposits.

Upgrade to have Adjusted Mediocre Interest levels, Yield Curves, and you will Section Prices

It mirrored a long build-upwards away from exhaustion, because the SVBFG could not effectively do as a result of a switching financial and you will economic environment inside 2022 and 2023. That it led to a crazy incapacity when SVBFG tried to do the newest severe situation after its February 8, 2023, harmony sheet restructuring announcement. Silicone Valley Bank’s board out of administrators and management didn’t manage the risks. See how far you might earn with assorted conditions, financing numbers and you can interest levels. Within the providing you with this article you have to know the new appropriateness of this guidance with regards to your sort of financial situation and you can demands. You will want to demand the merchandise Revelation Data files below and you may Market Determination before deciding to try to get issues having Financial Australian continent.

The interest costs revealed is for an amount of $five hundred so you can $step three,100,000 for personal consumers. To possess commercial consumers the attention cost found is actually for a cost away from $five-hundred to $step 1,000,000. That it memorandum surveys You.S. economic sanctions and you may anti-currency laundering (AML) improvements within the 2024 while offering a mindset to possess 2025. Estimations from for potential accountability to have 3M varied away from $8 billion in order to $25 billion. And never all plaintiff will accept the fresh payment offer and therefore may indicate of numerous billions much more in the an extra round from agreements. The following group of 39 plaintiffs already knowledgeable situation dismissals to possess varied reasons.

- The early withdrawal penalty equals either 180 otherwise 365 weeks’ easy attention, depending on the identity.

- By the participating in the brand new system, although not, the new depositor’s bank you’ll change $250,000 of this deposit that have some other bank in the circle and you will $100,000 that have another financial, and therefore the $600,000 of the unique put was FDIC covered.

- You’ll such PenFed’s certificates for individuals who’re also immediately after a seven-year identity with high production and you will prioritize customer support.

- Lowest deposit requirements out of $10,100 or maybe more inspired ratings negatively.

At the end of an excellent half a dozen-month name put, if your deposit “are at readiness”, you have got several options for the money. If the no step try removed, of many financial institutions usually immediately roll-over the put for the an alternative identity, probably during the an alternative interest. But not, you can even choose to flow your own money to some other bank, reinvest in the a new term put with the same bank, otherwise withdraw your money.

On the November 18, 2020, the new Income tax Judge awarded a viewpoint where they predominantly sided to the Internal revenue service. To the Late. 8, 2023, the new Income tax Courtroom provided an additional related opinion in addition to siding with the new Internal revenue service to your left matter. Possibilities and you will threats are seen as the Australian small enterprises browse electronic sales. The outcome and you can understanding regarding the interviews and you will questionnaire deliver the basis for so it report backed because of the CommBank, which will personally inform and you can reinforce all of our constant rules and advocacy objectives. It report brings for the performance and you can understanding of in the-breadth stakeholder interview, conducted in partnership with 89 Stages Eastern, along with nine COSBOA associate globe-leading companies. «We cannot and cannot be usually scrambling to take inside the fund to fund our very own sum in order to human liberties and balances,» Lazzarini said, worrying the necessity for «a far more renewable brand of funding… a predictable, long-name and you will normal way to obtain funding.»

DOJ, FDIC and you can OCC Upgrade Answers to Bank Merger Comment

To prevent logistical points, the brand new legal has generated particular deadlines for these submissions that are prior to when the individuals to own private submissions. These types of work deadlines is April 22, 2024, to have MSA III Wave Claimants and you can July 23, 2024, to have MSA We Claimants, for both EIF software and you may DPP supplementations. On the the total amount one to RateCity will bring economic suggestions, one suggestions are general and has not considered their objectives, financial situation or means. This is not a card seller, along with giving you information regarding credit things RateCity is not and then make any idea or recommendation to you from the a particular borrowing from the bank device. Think about the Unit Disclosure Report (PDS) and Market Dedication (TMD) before making a purchase choice. Label deposits are a good idea for most savers, as you may secure aside your money to have a period of time, to help you’t be easily tempted to withdraw it.

Ideal for step 3-12 months Cds

Licensed, covered financial institutions and certified, insured banks in the alliance having nonbank partners could fill out entire-lender offers otherwise bids to your places otherwise possessions of your own institutions. Lender and you will non-lender financial firms was allowed to quote for the asset profiles. The brand new FDIC’s ultimate goal inside the working a bridge establishment would be to get back the school in order to personal control as fast as possible. In the context of SVB and you will Trademark Financial, which goal is especially important, given the must provide stability and you will confidence in order to influenced depositors and consumers of the financial institutions, and also to look after balance and you will believe in the financial program and stalk the risk of contagion for other loan providers. Including Silvergate Lender, Signature Bank had in addition to centered a significant part of the team design to the digital investment globe.

Savvy Saver Account

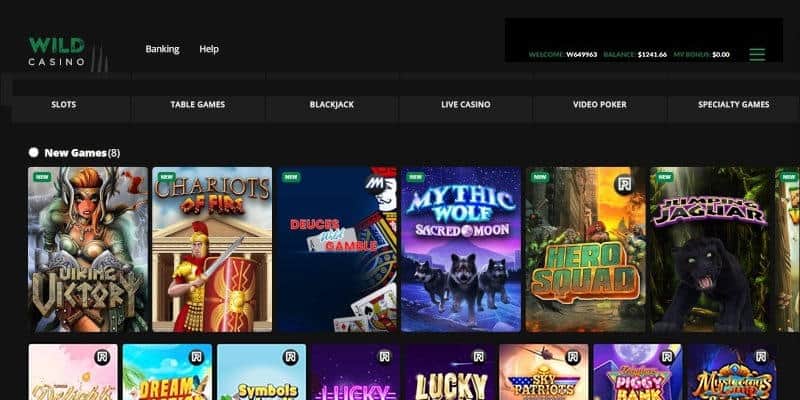

Before before profession away from Ukraine within the 1920s, in the 1918 there were intends to present very own Ukrainian management territorial division having area of modern Kirovohrad Oblast are split up anywhere between places out of Nyz (All the way down house), Pobozhia (Boh belongings), and you will Cherkasy. Playing Pub local casino is a wonderful choice to keep in mind if you would like play as opposed to risking plenty of your own fund. Because the gambling establishment is part of the newest Baytree (Alderney) Minimal brand, they operates for the Microgaming application and it has an excellent 50x enjoy-thanks to need for its incentives. Which user is the most Canada’s longest-running and more than common casinos, and i also just like their work at athlete security.

Because the previously detailed, the industry’s unrealized loss on the securities were $620 billion at the time of December 31, 2022, and you may flames transformation inspired by deposit outflows have next depressed cost and you can impaired guarantee. Inside the March away from 2023, there is a hurry to the Silicone Valley Bank (SVB) when their depositors, nearly all just who had been uninsured, noticed that the financial institution was at issues down to unrealized loss for the the bonds collection. Another banking institutions along with experienced runs, most notably Trademark Bank and you will Earliest Republic Financial. Because the panic among us lender depositors subsided when government lender regulators secured the funds of uninsured depositors from the SVB and you will Signature, the fresh turmoil and uncertainty offered You banking companies a lot more bonus so you can assures its uninsured depositors of the shelter of the fund. A good way they did this was to improve their usage of mutual dumps as a way away from effortlessly growing put insurance rates. Financial institutions and you may borrowing from the bank unions tend to play with a list price, often the federal finance rates (also known as the brand new “fed price”), because the a base setting prices for everybody focus-results accounts, and Computer game prices.

Uninsured dumps, concurrently, are usually perhaps not protected, although they get at some point be manufactured whole as is the situation when a systemic chance exclusion to help you “least-costs quality” is invoked. 5 This really is divided to the forty eight banking organizations with increased than $50 billion overall possessions and you will 66 financial groups that have anywhere between $5 billion and you will $50 billion overall property. Let’s assume you’ll find 2 hundred,one hundred thousand legitimate times, and the mediocre payment payment is $100,100 for every individual. In order that is a concern one to plaintiffs’ solicitors experience in these instances. Detailed advice because of it vast majority entry process was offered to the new lead plaintiffs’ attorneys on the Friday.